Loan repayment calculator for our payday loans

Representative example: Borrow £700 for 5 months. 4 monthly repayments of £235.82, last monthly repayment of £235.92. Total repayment of £1,179.10. Interest rate p.a. (fixed) 222.79%. Representative APR 821.04%. Daily interest is capped at 0.798%. Representative APR includes all applicable fees.

Warning: Late repayment can cause you serious money problems. For help, please go to www.moneyhelper.org.uk

Considering a payday loan? Navigating through the maze of APRs, interest rates, and fees on lenders’ websites can be daunting. We’re here to simplify things and give you a clear picture of what you’ll pay for a short-term loan.

In this article, we’ll cover three key areas:

- How to calculate a payday loan manually.

- How to use our payday loan calculator for precise loan details.

- A breakdown and estimates table for various loan scenarios with us.

How to calculate a payday loan

There are two methods to calculate the total cost of your payday loan: manually or using our calculator.

We’ll show you how to calculate a payday loan manually first.

Method 1: manual calculation

If you’re interested in calculating a payday loan manually, you can use the loan amount, daily interest rate, and loan duration combined to determine the total cost.

Simply follow this formula:

Total loan amount x daily interest rate x loan duration = Total Interest

For example, if you borrow £500 at a daily interest rate of 0.507% and a loan duration of 3 months, your calculation would be: £500 x 0.00507 x 90 days = £227.86 in interest.

This means you will pay £227.86 in interest. Now that you know the total interest, you can simply add the loan amount and the interest together to find the total amount you will have to repay:

Total loan amount + Total Interest = Total Amount you have to repay.

The calculation would be: £500 + £227.86 = £727.86

So, the total amount you have to repay for a £500 payday loan with a daily interest rate of 0.507% and a 3-month loan duration is £727.86.

Now that you know the total amount you have to repay, you can determine how much you need to repay each month by dividing the total amount by the number of loan duration months:

Total amount you have to repay / Loan duration = Monthly Repayment Amount.

£727.86 / 3 months = £242.62

Therefore, you would need to repay approximately £242.62 each month for a 3-month payday loan of £500 with the specified interest rate.

Understanding these calculations helps you plan your budget effectively, ensuring you can manage your monthly repayments and stay on top of your financial commitments.

It’s essential to be well-informed before taking out a payday loan to make the best financial decisions for your situation.

Another way to calculate the total cost of a payday loan is by using the APR (Annual Percentage Rate). You can learn more about APR explained for payday loans to understand this method better.

Method 2: use our calculator

Next, let’s explore how to use our payday loan calculator to calculate loan details

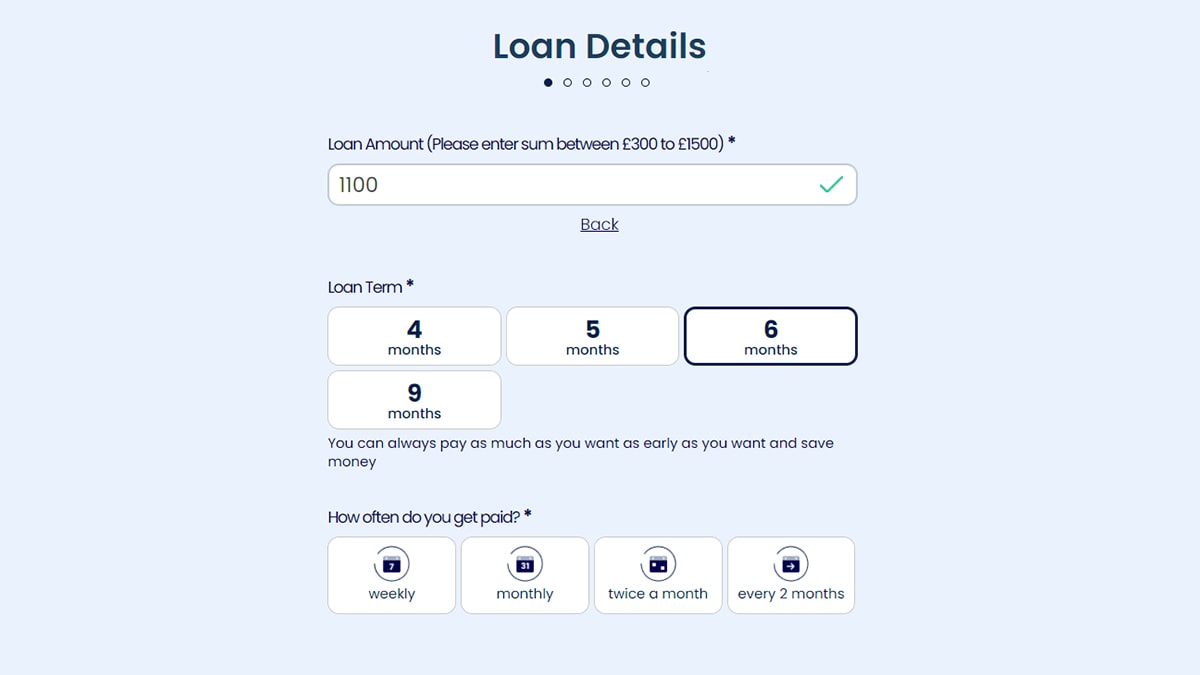

Our loan calculator, located at the beginning of our loan application form, empowers you to calculate your total monthly, weekly, or bi-weekly payments, depending on your preference. You can also clearly see the exact amount of total interest in pounds that will be charged and the total repayment amount, which includes the original borrowed sum and the interest rate. Additionally, you’ll have access to your repayment schedule, including due dates. With the flexibility to choose different loan amounts and durations, you can select terms that align with your preferences.

Here’s the best part: Our calculator doesn’t require any personal or financial information. It simply asks for the amount you want to borrow, the loan term’s duration, your pay frequency, and when you’d like to make your initial payment. This information sets up your repayment schedule. Moreover, we offer an easy start option, which allows you to adjust the repayment schedule so that your first payment is smaller than the subsequent ones, making it easier to manage in the first month.

Our calculator is at the beginning of our loan application form and lets you calculate monthly, weekly, or bi-weekly payments.

Ready to apply for a loan with us?

Or learn more about our direct lender payday loans

Payday loan estimation examples

Below is a breakdown and estimates table for various loan scenarios when you lend from us:

| Loan amount | Loan duration (months) | Total interest | Total repayable | Monthly repayment amount |

|---|---|---|---|---|

| £300 | 3 | £142.35 | £442.35 | £147.45 |

| £400 | 3 | £165.00 | £565.00 | £188.30 |

| £400 | 4 | £208.95 | £608.95 | £152.25 |

| £500 | 3 | £205.90 | £705.90 | £235.30 |

| £500 | 4 | £260.50 | £760.50 | £190.10 |

| £500 | 5 | £299.00 | £799.00 | £159.80 |

| £500 | 6 | £338.10 | £838.10 | £139.70 |

| £600 | 3 | £246.70 | £846.70 | £282.20 |

| £600 | 4 | £311.50 | £911.50 | £227.90 |

| £600 | 5 | £357.45 | £957.45 | £191.50 |

| £600 | 6 | £404.85 | £1004.85 | £167.50 |

| £700 | 3 | £287.25 | £987.25 | £329.10 |

| £700 | 4 | £362.35 | £1062.35 | £265.60 |

| £700 | 5 | £416.15 | £1116.15 | £223.25 |

| £700 | 6 | £464.35 | £1164.35 | £194.05 |

| £800 | 3 | £319.60 | £1119.60 | £373.20 |

| £800 | 4 | £404.70 | £1204.70 | £301.20 |

| £800 | 5 | £466.20 | £1266.20 | £253.25 |

| £800 | 6 | £529.30 | £1329.30 | £221.55 |

| £900 | 3 | £358.90 | £1258.90 | £419.65 |

| £900 | 4 | £453.90 | £1353.90 | £338.50 |

| £900 | 5 | £523.15 | £1423.15 | £284.65 |

| £900 | 6 | £593.85 | £1493.85 | £249.00 |

| £1000 | 4 | £502.90 | £1502.90 | £375.75 |

| £1000 | 5 | £579.65 | £1579.65 | £315.95 |

| £1000 | 6 | £658.10 | £1658.10 | £276.35 |

| £1000 | 9 | £769.65 | £1769.65 | £196.60 |

| £1100 | 4 | £552.35 | £1652.35 | £413.10 |

| £1100 | 5 | £636.85 | £1736.85 | £347.40 |

| £1100 | 6 | £712.95 | £1812.95 | £302.15 |

| £1100 | 9 | £836.85 | £1936.85 | £215.20 |

| £1200 | 5 | £681.95 | £1881.95 | £376.40 |

| £1200 | 6 | £776.75 | £1976.75 | £329.45 |

| £1200 | 9 | £911.80 | £2111.80 | £234.65 |

| £1300 | 5 | £737.85 | £2037.85 | £407.55 |

| £1300 | 6 | £840.10 | £2140.10 | £356.70 |

| £1300 | 9 | £986.25 | £2286.25 | £254.05 |

| £1400 | 6 | £903.55 | £2303.55 | £383.95 |

| £1400 | 9 | £1061.10 | £2461.10 | £273.45 |

| £1500 | 6 | £967.00 | £2467.00 | £411.20 |

| £1500 | 9 | £1136.15 | £2636.15 | £292.90 |

Please keep in mind that these values are just examples; it’s best to use our calculator for more accurate estimates.

The bottom line

Our goal is to make it easy for you to understand payday loan costs. We use clear methods to calculate your loan cost. Our loan calculator and examples give you a straightforward view of how we work out these costs. We aim to help you understand the calculations, enabling you to know exactly how much a loan will cost, even before you apply