APR explained for payday loans

When it comes to comprehending the cost of a payday loan, understanding APR is vital. APR, or Annual Percentage Rate, represents the yearly interest rate charged when you borrow a payday loan for a 12-month period.

However, it’s equally important to acknowledge that payday loans serve as short-term solutions, meant to cover expenses until your next payday or for a period of 1-6 months. Therefore, using APR to calculate the real cost of a loan involves extending it over 12 months, which may not accurately reflect the shorter loan duration.

In this article, we will delve into the concept of APR within the realm of payday loans. We’ll explain the calculation of APR and its significance. Additionally, we’ll address the limitations of APR in providing an accurate depiction of expenses associated with short-term payday loans. To enhance your understanding, we’ll introduce a more precise method for evaluating payday lenders, helping you identify those offering more favorable terms.

What is APR for payday loans?

APR, or Annual Percentage Rate, for payday loans represents the total interest and fees you would pay if you borrowed the loan for a full year. This includes not just the interest (the extra money paid back on top of the borrowed amount) but also any additional fees or charges. All these factors combined give you the total APR percentage.

Why is the APR for UK payday loans so high?

Some payday lenders charge extremely high APRs, often exceeding 1,250%. The reason APRs are so high is because most times if you are getting a payday loan, you might have less than perfect credit and because the loans are unsecured, there is often a high risk of defaulting on the loan. So, payday lenders will charge you a much higher APR as a way to cover their risk and to allow them to still be profitable even with the high default rate.

How APR is calculated for a payday loan

Calculating APR for a payday loan may seem a bit complex, but we’ll break it down step by step in an easy-to-follow way:

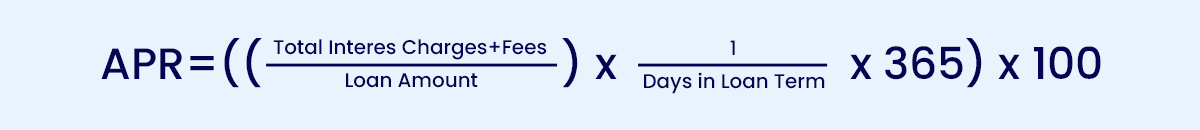

Here’s the formula to calculate APR:

To calculate the APR manually you would follow these 6 steps:

- Find the interest rate and charges.

- Add the fees to the interest charges.

- Divide this sum by the principal balance.

- Divide the result by the number of days in the loan’s term.

- Multiply by 365 to annualize.

- Multiply by 100 to convert to a percentage.

How to use APR

Thanks to the rules from the FCA (Financial Conduct Authority), payday lenders in the UK are required to do the APR calculations for you. So when you choose the loan amount and the duration you’ll borrow the money for, the lender will calculate the APR for you so you won’t have to do the math yourself.

But why is APR important? Well, it’s like a price tag for payday loans. When you’re checking out different payday lenders, you can look at the APR they show on their websites. This percentage number helps you quickly evaluate which lenders are more expensive. So, when you’re considering a payday loan, keep an eye on the APR to help you pick a lender that has a lower APR rate.

APR regulations and caps

The Financial Conduct Authority (FCA), which oversees payday lenders, doesn’t set a maximum APR for lenders. Instead, they’ve placed limits on daily interest, total fees, and repayment amounts. By law, lenders can’t charge more than 0.8% per day in interest. Additionally, the total loan cost, including fees and interest, can’t exceed twice the original loan amount. There’s also a £10 cap on default charges. These rules protect borrowers from high charges and ensure payday loans stay manageable. Learn more about the FCA regulations on APR.

Factors to consider beyond APR

When considering a short-term payday loan, don’t rely solely on the APR, as it may not provide an accurate cost estimate. Instead, focus on these three things:

Daily Interest Rate: Start by examining the lender’s daily interest rate. Look for the lowest rate available.

Total Fees: Pay close attention to all fees associated with the loan, including origination fees and any additional charges.

Total Loan Cost: Ensure that the lender is regulated by the FCA (Financial Conduct Authority). This regulation guarantees that, at worst-case scenario, the total repayment, including both fees and interest, won’t exceed double the original loan amount.

Always prioritize lenders with lower interest rates and fewer fees to effectively minimize the overall cost of a payday loan.

To learn how to manually calculate a payday loan’s true costs rather than using APR, read calculating a Payday loan manually.

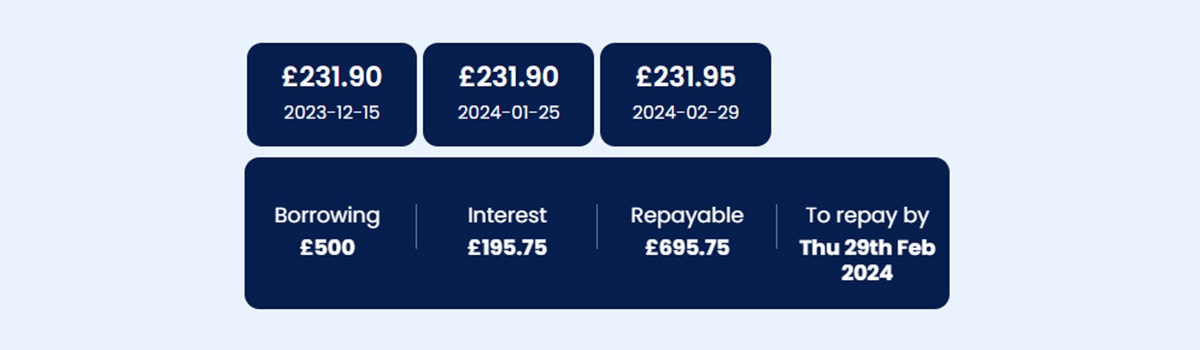

How to evaluate our rates and fees

We take pride in being clear about our rates and fees when you apply for a payday loan online with us. When you click on the application link, you’ll be asked to enter the loan amount you need, the duration you’d like to borrow it for, and your preferred repayment start date. Afterward, you’ll see a detailed explanation of the computations, including the borrowed amount, the total interest to be paid, the overall repayment amount, and your final repayment date. This ensures that you have a full understanding of the costs before proceeding with your application and providing your personal information.

The bottom line

While understanding the APR is important when considering a payday loan, don’t rely solely on this number. Payday loans are typically short-term, making the annual rate less relevant for these loans. Instead, focus on two key factors when researching lenders: First, seek out lenders with the lowest daily interest rate, as it directly impacts the amount you’ll pay. Second, carefully examine all fees associated with the loan, including origination fees and any additional charges, and opt for loans with fewer fees. Additionally, always choose a lender regulated by the Financial Conduct Authority (FCA) to benefit from the protections they have established by law regarding how much a payday lender can charge you. Citizens Advice offers valuable insights into the topic of APRs if you want to go into even more detail.