Loans without a guarantor

Need to get a loan without a guarantor? Apply for a no guarantor loan now, receive a decision in seconds, and the cash paid into your bank account fast.

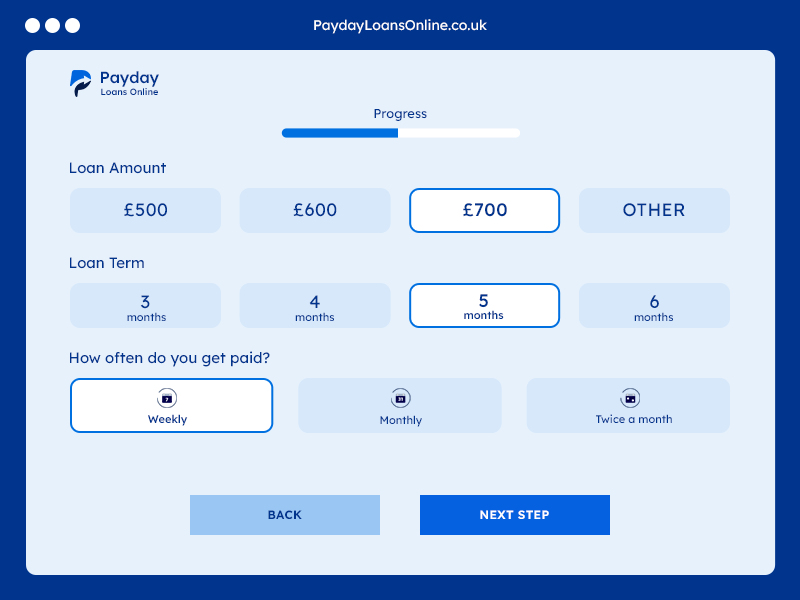

Representative example: Borrow £700 for 5 months. 4 monthly repayments of £235.82, last monthly repayment of £235.92. Total repayment of £1,179.10. Interest rate p.a. (fixed) 222.79%. Representative APR 821.04%. Daily interest is capped at 0.798%. Representative APR includes all applicable fees.

Warning: Late repayment can cause you serious money problems. For help, please go to www.moneyhelper.org.uk

Loans without a guarantor

Some lenders require at least one guarantor before lending you money. We feel this is unfair.

If you need a loan but lack a guarantor or prefer not to depend on another person, we have a solution for you – our no guarantor loans.

You can borrow between £300 and £1,500 at a daily interest rate of 0.507%, which is 185.39% per annum without needing someone to provide a guarantee.

No guarantor loan details

Loan Amounts:

£300 – £1,500

Daily Interest Rate:

0.507%

Interest Per Annum:

185.39%

Repayment Terms:

3 – 9 months

Funding Time:

Same-day

APR:

821.04%

How to Get an Unsecured Loan

In 4 Simple Steps

Step 1. Apply Online

Complete our online application for an unsecured loan. No collateral or guarantor is needed so you keep full control over your assets and finances.

Step 2. Get an Instant Decision

We assess your income, credit, and eligibility then provide an instant decision on your unsecured loan with transparent criteria.

Step 3. Receive Your Money

Your unsecured loan funds are paid directly to your bank account, often within minutes, with no assets required as security.

Step 4. Repay Over 3 to 6 Months

Repay your unsecured loan in fixed monthly amounts over 3 to 6 months with no risk to your property or other assets.

Pros and cons of getting a loan that does not require a co-signer

Before you commit, weigh the pros and cons of a loan that does not require a guarantor to confirm if this is the right type of loan for you based on your current financial circumstances.

Pros

- You won’t need to rely on a specific person to secure the financing you require.

- Avoiding the need for a guarantor helps you maintain healthy personal relationships.

- You won’t have to share your financial situation with family or friends

- Loans without a guarantor are typically processed more swiftly.

Cons

- These loans often come with higher interest rates.

- A stable income and a solid credit history may be necessary for eligibility.

- Lenders may impose lower borrowing limits for these types of loans.

- Defaulting on a loan without a guarantor leaves you without financial help to payback the debt.

FCA-Authorised direct lender

We have been authorised and regulated by the Financial Conduct Authority (FCA) since 13/05/2016 under license 714479, giving you peace of mind that you are dealing with a reputable direct lender.

ICO Registration

We have been registered with the Information Commissioner’s Office (ICO) since 17/08/2012 under registration number Z3305234, so you know we follow strict data protection and privacy practices.

Cost of borrowing £600 example

Here’s a breakdown of the full cost of getting a no guarantor loan of £600 from us. The table includes your repayment period, interest rate, repayment structure, interest paid, total repayment, and representative APR.

For more cost breakdowns on different loan amounts, check our list of loan cost examples.

| Details | Example |

|---|---|

| Loan amount | £600 |

| Loan period | 3 Months |

| Interest rate P.A. (fixed) | 185.39% |

| 3 monthly repayments | £282.20 |

| Total interest paid | £246.70 |

| Total repayment | £846.70 |

| Example APR | 611.74% |

Who is Payday Loans Online?

Payday Loans Online is a trading style of Western Circle LTD, a trusted direct payday lender that has served UK customers since 2016. Our company registration number is 7581337, and our offices are at Office 9, 2A Highfield Avenue, London, NW11 9ET, United Kingdom.

We have funded over £19 million in fast, secure loans. We have directly helped more than 115,000 borrowers across the UK – from Cornwall in the south to Caithness in the north.

Our lending decisions are fair, transparent, and responsible. We carefully assess and individually review each loan application. This process ensures that every loan decision fits the potential borrower’s current financial circumstance.

Since the Financial Conduct Authority (FCA) implemented an interest cap in 2015, we have consistently adhered to all regulatory requirements. We remain committed to acting as a responsible lender, safeguarding the interests of our customers by implementing strict, compliant lending practices.

Why choose us?

We’ve been providing short term loans to new and repeat customers across the UK since 2016. Here’s why they trust us – and why you can too with your loan application:

- No Broker Fees – We fund your loan with our own money. You won’t pay broker fees.

- FCA Regulated – We are fully authorised by the Financial Conduct Authority (FCA) under license 714479 since 2016.

- No Hidden fees – We clearly show interest rates, repayment term and total repayment amount upfront

- Your Data is Safe – We follow strict data protection laws. Your personal information is secure and kept private.

- Data Compliant – We are officially registered with the Information Commissioner’s Office (ICO) since 2012.

- Proven Track Record – We have provided payday loans since 2016 proving a strong track record.

- 115k Customers Served – We have directly funded over 115,000 customers all across the UK.

- Responsible Lending Practices – Every loan application goes through a thorough affordability check

- Flexible Repayment Plans – You can repay your loan over 3 to 9 months instead of by your next payday.

- Poor Credit Considered – We welcome applications from customers with less-than-perfect credit.

- Superior Lending Technology – Our team develops our loan systems, resulting in fairer loan decisions.

- Website Security – Our site is encrypted and managed by experts who take data protection seriously.

- UK-Based Support – Our support team is local and responsive. Real people are ready to help you.

- Easily Accessible – Call us or email us between 9 AM – 5:30 PM (Mon-Fri).

- Early Repayment is Possible – Repay your loan early anytime. No penalties, and you save on interest.

- Same-Day Funding – Guaranteed same-day funding for approved loans.

Frequently Asked Questions

A non-guarantor loan means you take sole responsibility for borrowing and repaying money. No need for a guarantor; it’s just between you and our company.

Yes, you can secure a loan without a guarantor even with bad credit, though it can be challenging. We specialize in bad credit loans that don’t require a third-party guarantee.

While a payday loan doesn’t need a guarantor, it’s not the only option. Various short-term unsecured loans allow you to borrow without a guarantee.

You can borrow up to £1,500 from us without a guarantor, depending on our affordability and creditworthiness checks.

Our loans are typically unsecured, meaning they don’t require collateral like a house or car. Lenders rely on your creditworthiness. These loans often have higher interest rates due to increased risk.

Yes, loans without a guarantor usually have higher costs. They come with higher interest rates and less favorable terms because lenders view them as riskier, especially for those with poor credit. The higher interest compensates for the added risk of no guarantor.

Yes, you can repay our loans early. Most loans allow early repayment, and there are no early repayment fees or penalties.

Once approved, you typically receive the money within minutes, with same-day funding guaranteed.

Our loan offerings include a ‘No Guarantor Loan,’ ‘Bad Credit Loans,’ ‘Payday Loans,’ and ‘Installment Loans,’ each designed for specific financial needs without requiring a guarantor.

You can use our loans for anything you want, including debt consolidation, home improvements, medical bills, car repairs, education, travel, weddings, or emergencies, as long as you can manage repayment.

Boost your chances by showing stable, sufficient income, reducing your debt-to-income ratio, and requesting an affordable loan amount. Stable income reassures lenders, a lower debt-to-income ratio signifies financial health, and a realistic loan amount signals responsible borrowing.

Our fees are fixed for no guarantor loans and are the same rates as other loans we offer. No additional fees or interest charges.

Make monthly payments more manageable by spreading them over 3-6 months, reducing your monthly repayment amount.

No penalties for early repayment; you can reduce your interest by paying off the loan ahead of schedule.

Yes, we conduct a credit check, starting with a soft check that doesn’t affect your credit score. A full credit check follows, but your approval is already secured at that point, with no negative impact on your credit score.

Ready to apply online?

No hidden costs or fees

No paperwork

Flexible repayments

Bad credit considered

No obligation to accept

FCA authorized direct lender