Installment loans for People in the UK

Need a loan you can repay in installments? Apply for an installment loan today and repay over 3 to 6 months with small, predictable monthly installments.

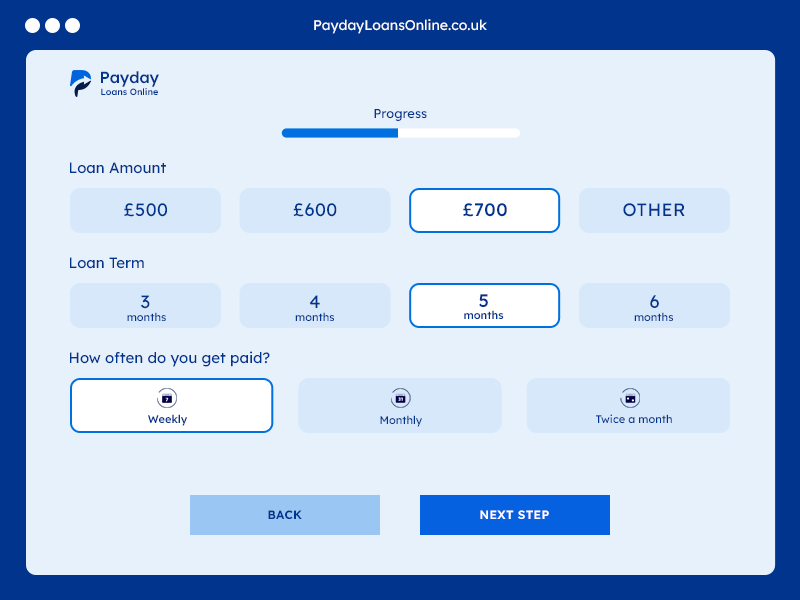

Representative example: Borrow £700 for 5 months. 4 monthly repayments of £235.82, last monthly repayment of £235.92. Total repayment of £1,179.10. Interest rate p.a. (fixed) 222.79%. Representative APR 821.04%. Daily interest is capped at 0.798%. Representative APR includes all applicable fees.

Warning: Late repayment can cause you serious money problems. For help, please go to moneyhelper.org.uk

Loans that you can repay over a longer period of time

Getting an installment loan can be difficult to obtain if you have low income, outstanding debts, or a poor credit history. Avoid paycheck lenders or short term lenders who are only approve your loan based on your credit rating. Instead, apply for an installment loan through PaydayLoansOnline. We approve your loan based on a fairer evaluation of your current financial situation.

Installment loan example

| Payday Loan Feature | Rates & Terms |

|---|---|

| Loan amounts | £300 – £1,500 |

| Daily interest rate | 0.507% |

| Interest per annum | 185.39% |

| Repayment terms | 3 – 6 months |

| Funding time | Same-day |

| Representative APR | 821.04% |

What is an installment personal loan?

An installment personal loan is a type of loan that is repaid over a longer period of time with a fixed number of scheduled payments. Installment loans are generally larger than standard payday loans and are paid back over a longer period of time. This loan type can be used for different reasons, including consolidating debt, financing a large purchase, or making a major home improvement. Payday loans Online offer traditional payday loans and also larger, longer-term installment loans. Simply click on the get approved button below to apply for an installment loan.

How to Get an Installment Loan

In 4 Simple Steps

Step 1. Apply Online

Apply for an installment loan online and tell us the amount you need. No paperwork is required and everything is quick and secure.

Step 2. Get an Instant Decision

We run fast eligibility checks and provide an instant decision so you know straight away if you have been approved for your installment loan.

Step 3. Receive Your Money

Funds are paid directly into your bank, usually within minutes, so you have immediate access to your installment loan.

Step 4. Repay Over 3 to 6 Months

Repay your installment loan over 3 to 6 months in fixed monthly instalments making it easy to plan your budget.

What you need to know

If you are looking to spread a short term expense over a more extended period, you can apply for safe and affordable installment loans online. Unlike traditional payday loans, UK lenders have designed this product to make the monthly repayments more manageable. It is essential to check and compare interest rates on these loans and to ensure that the price you pay for borrowing this “easy to repay money” makes sense in your current situation.

Applying for a loan from a direct lender rather than a broker can help you save on brokerage fees, and can help get you the funds faster by avoiding third parties.

Key points

- We are a fair and transparent direct lender

- All credit scores considered

- Get the money in your bank account within 1 hour, if approved

- Make flexible repayments in monthly installments

- Repay your loan early and save on interest at no extra charge

Key requirements

To apply for a loan with PaydayLoansOnline, you must:

- Be a UK Resident

- Be above 18 years old

- Hold a UK bank account

- Have a steady source of income (i.e. pension, benefits etc.)

Will I be accepted for an installment loan?

At PaydayLoansOnline, we will do everything we can to fund you a loan. We consider all applicants regardless of their credit score. As long as you have enough disposable income to make the monthly repayments, and borrowing money won’t harm your finances, we will happily approve your loan application.

Our loans can be repaid in up to 6 monthly installments. We provide a repayment plan designed specifically for every customer. This makes the monthly repayments more manageable and enables you to get your finances back on track quickly.

Cost of borrowing £900 example

Here’s a breakdown of the full cost of getting an installment loan of £900 from us. The table includes your repayment period, interest rate, repayment structure, interest paid, total repayment, and representative APR.

For more cost breakdowns on different loan amounts, check our list of loan cost examples.

| Details | Example |

|---|---|

| Loan amount | £900 |

| Loan period | 6 Months |

| Interest rate P.A. (fixed) | 185.39% |

| 6 monthly repayments | £249.00 |

| Total interest paid | £593.85 |

| Total repayment | £1493.85 |

| Personal APR | 611.74% |

Who is Payday Loans Online?

Payday Loans Online is a trading style of Western Circle LTD, a trusted direct payday lender that has served UK customers since 2016. Our company registration number is 7581337, and our offices are at Office 9, 2A Highfield Avenue, London, NW11 9ET, United Kingdom.

We have funded over £19 million in fast, secure loans. We have directly helped more than 115,000 borrowers across the UK – from Cornwall in the south to Caithness in the north.

Our lending decisions are fair, transparent, and responsible. We carefully assess and individually review each loan application. This process ensures that every loan decision fits the potential borrower’s current financial circumstance.

Since the Financial Conduct Authority (FCA) implemented an interest cap in 2015, we have consistently adhered to all regulatory requirements. We remain committed to acting as a responsible lender, safeguarding the interests of our customers by implementing strict, compliant lending practices.

FCA-Authorised direct lender

We have been authorised and regulated by the Financial Conduct Authority (FCA) since 13/05/2016 under license 714479, giving you peace of mind that you are dealing with a reputable direct lender.

ICO Registration

We have been registered with the Information Commissioner’s Office (ICO) since 17/08/2012 under registration number Z3305234, so you know we follow strict data protection and privacy practices.

Why choose us?

We’ve been providing short term loans to new and repeat customers across the UK since 2016. Here’s why they trust us – and why you can too with your loan application:

- No Broker Fees – We fund your loan with our own money. You won’t pay broker fees.

- FCA Regulated – We are fully authorised by the Financial Conduct Authority (FCA) under license 714479 since 2016.

- No Hidden fees – We clearly show interest rates, repayment term and total repayment amount upfront

- Your Data is Safe – We follow strict data protection laws. Your personal information is secure and kept private.

- Data Compliant – We are officially registered with the Information Commissioner’s Office (ICO) since 2012.

- Proven Track Record – We have provided payday loans since 2016 proving a strong track record.

- 115k Customers Served – We have directly funded over 115,000 customers all across the UK.

- Responsible Lending Practices – Every loan application goes through a thorough affordability check

- Flexible Repayment Plans – You can repay your loan over 3 to 9 months instead of by your next payday.

- Poor Credit Considered – We welcome applications from customers with less-than-perfect credit.

- Superior Lending Technology – Our team develops our loan systems, resulting in fairer loan decisions.

- Website Security – Our site is encrypted and managed by experts who take data protection seriously.

- UK-Based Support – Our support team is local and responsive. Real people are ready to help you.

- Easily Accessible – Call us or email us between 9 AM – 5:30 PM (Mon-Fri).

- Early Repayment is Possible – Repay your loan early anytime. No penalties, and you save on interest.

- Same-Day Funding – Guaranteed same-day funding for approved loans.

Frequently Asked Questions

The maximum loan amount we offer is currently £1,500 which is payable over 7, 8 or 9 months.

Depending on the loan amount, loan duration and your payday, your monthly repayments will change. You will always be able to see a full repayment plan with the exact amounts you’ll need to pay back each month at the first stage of the application form.

Of course! You can always pay your loan back early and save on interest, and there is no penalty for doing so.

Ready to apply online?

No hidden costs or fees

No paperwork

Flexible repayments

Bad credit considered

No obligation to accept

FCA authorized direct lender