Safe Alternatives to Sunny Loans: How to Borrow Smarter in 2025

- Sunny Loans no longer lend. Payday Loans Online is a fast alternative, offering short-term loans from $300 up to $1,500 for urgent needs.

- Sunny Loans shut down in 2020 and no longer offers any payday loans or new lending services.

- Payday Loans Online offers short-term loans from £300 to £1,000 with no hidden fees and same-day funding if approved.

- You should only use payday loans for short-term emergencies and seek free help if you’re struggling with debt.

If you’re searching for a payday loan and Sunny popped up in your search, you’re in good company. For years, Sunny was a big name in short-term loans. Tough times and strict new rules eventually forced them to close. You might be anxious about which lenders are still safe and who you can trust. Let’s walk through what happened to Sunny, your alternatives now, and how Payday Loans Online can help.

Why You Need an Alternative to Sunny

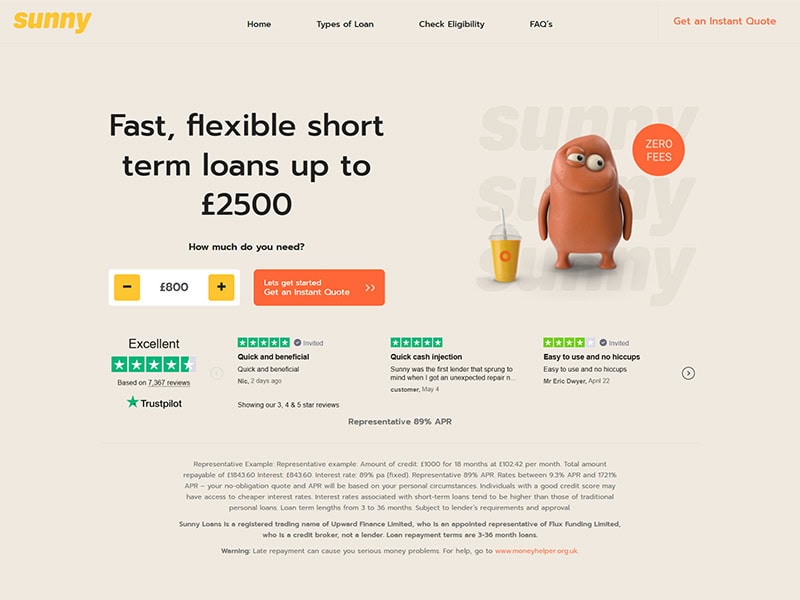

Sunny, once operated by Elevate Credit International Ltd, entered administration and ceased all lending in June 2020. Like Wonga, QuickQuid, and others, Sunny was hit hard by compensation claims, FCA regulations, and the pressures of the Covid pandemic. Today, Sunny no longer offers any new loans.

If you’re an ex-Sunny customer owed compensation, the unfortunate reality is that most received little to no payout. It’s understandable to feel wary of online loans after all this.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we’re committed to building trust the right way:

- Authorised and regulated by the Financial Conduct Authority (FCA). This means every loan we offer follows strict UK rules designed to protect you.

- Direct lender: We don’t pass your details to third parties. You deal with us from start to finish.

- Clear, upfront costs: No confusing small print or hidden fees. You’ll always know what you owe.

- Short-term: Flexible loans let you borrow £300 to £1,000 for three to six months. That’s just enough to handle emergencies without building up debt.

- No rollovers or multiple loans: Our strict policy protects you from spiralling into debt.

- Bad credit considered: We look at your real circumstances, not just your credit score.

TIP: I always recommend you double-check that any lender you use is authorised by the FCA. This protects you from scams and ensures you get fair treatment.

Compare Application, Speed, Cost, and Eligibility

| Feature | Sunny Loans (Closed 2020) | Payday Loans Online |

|---|---|---|

| Lending status | Ceased all operations | Open to new applicants |

| Loan amount | Up to £2,500 | £300–£1,000 (payday loans) |

| Loan term | Up to 14 months | 3–6 months |

| Direct lender | Yes (when open) | Yes |

| Bad credit welcome | Yes | Yes |

| Multiple loans | Sometimes allowed | Never allowed |

| Early repayment | Allowed | Encouraged no fees |

| Application | Online | Online instant decisions |

| Funding speed | Same day | Within an hour if approved |

| Reviews | Mixed, now defunct | 4.1/5 on Trustpilot |

What to Do If You’re Struggling With Debt

Sunny’s collapse highlighted just how risky payday lending can be, especially for customers already facing financial stress. If you’re worried about your borrowing:

- Take a careful look at your finances. List every source of income and all your essential spending.

- Before taking out a new loan, consider alternatives. Could you ask your energy provider for a payment plan, borrow from a friend, or sell unwanted items?

- If your debts are getting out of control, contact a charity like StepChange or Citizens Advice for free, confidential support.

Remember: Payday loans are designed for short-term emergencies only. They are not the answer to long-term money worries.

TIP: I’ve seen many people get real relief just by talking to their energy supplier or landlord. You may be surprised how often they’ll agree to a payment plan if you explain your situation.

How to Apply

- Visit our website for a simple, secure application.

- Enter your details, including your income, spending, and needs.

- Receive an instant decision with no waiting for days.

- Funds are sent fast, usually within the hour if approved.

- Manage your loan online. Track payments, repay early, or get help from our friendly team.

You can also use our affordability checker, just like the old Sunny calculator, to see if a loan is suitable for you with no impact on your credit score.

Responsible Borrowing Tips

- Only borrow if it’s a real emergency and you know you can repay.

- Check your total repayment before you agree to any loan.

- Set reminders for payment dates. Missing a payment can make things much worse.

- Repay early if you can to save money and gain peace of mind.

- For ongoing worries, always seek free help. Never borrow just to pay off another loan.

TIP: I have found that using a simple calendar reminder on your phone can help you avoid missing payments and extra charges.

Where This Leaves You and Your Choices

The payday loan world is changing. Big names like Sunny are gone, but you still need clear, honest support when life takes a turn. With Payday Loans Online, you get responsible, FCA-regulated lending and real customer service. No hidden traps, no rollovers, just a helping hand in tough times.

- Want clear answers and direct help?

- Need cash fast, without risking a debt spiral?

- Prefer a lender who puts your wellbeing first?

If so, start your application today or call us for honest advice. We’re here to help every step of the way.

Application and Approval Process FAQ

- Who can apply with you if I used Sunny before?

Any UK resident over 18, with a regular income and a UK bank account. Bad credit considered. - How fast is the decision?

Usually instant. You’ll know right away if you’re approved. - How soon can I get my money?

If approved, often within the hour. - What if I want to pay back early?

Great! There are no penalties, and you save on interest. - Who supports me if I struggle to repay?

Contact our team immediately. We’ll work with you, not against you.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.