Safe Alternatives to SafetyNet Credit: A Better Way to Borrow

- SafetyNet Credit no longer lend. Payday Loans Online is a fast alternative, offering short-term loans from $300 upto $1,500 for urgent needs.

- SafetyNet Credit stopped lending in January 2023 after its revolving loan model led to widespread borrower harm.

- Fixed-term loans give you full control by showing upfront costs and a clear end date with no surprise top-ups or rollovers.

- You can borrow safely without linking your bank account by choosing lenders that don’t monitor your transactions.

If you’re urgently looking for funds and SafetyNet Credit has crossed your mind, you might feel overwhelmed by the options out there. You deserve a simple, clear solution without surprises or ongoing debt. Let’s walk through your options and see why a fixed-term loan from Payday Loans Online might be the fresh start you need.

Why You Might Need an Alternative to SafetyNet Credit

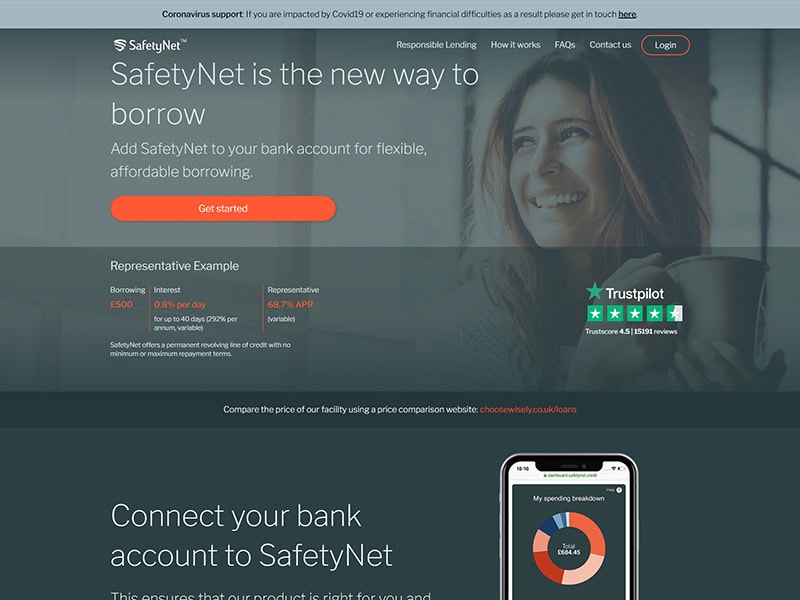

SafetyNet Credit launched in 2015 with a new twist: a “credit line” you could tap into any time. You linked your bank account, and the system tracked your balance to offer “smart” top‑ups when funds were low. Convenient? Yes. But for many, it meant less privacy, constant monitoring, and a real risk of getting trapped in a cycle of debt.

More importantly, it ceased offering new loans after entering administration on 9 January 2023. The FCA placed tight restrictions because the credit line model had harmed hundreds of thousands of customers, including those with Creditspring.

SafetyNet remains FCA-authorised, but they’re no longer lending. Their past practices left many borrowers vulnerable.

TIP: I always recommend avoiding credit models that monitor your bank account constantly. This can push you to borrow more than you need and trap you in debt. Instead, choose lenders who respect your privacy and offer fixed loans so you control how much you borrow and repay.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we believe borrowing should be:

- Fixed-term loans: You know exactly what you owe and when you’re debt-free.

- No bank monitoring: We don’t track your transactions or link your account.

- FCA‑regulated: We follow the Financial Conduct Authority’s rules, and we’re checked regularly.

- Transparent: No hidden fees. Pay early and save on interest.

- Inclusive: We assess affordability, not just your credit score.

You stay in control. With clarity. With privacy.

Compare Application, Speed, Cost, and Eligibility

| Feature | SafetyNet Credit | Payday Loans Online |

|---|---|---|

| Loan type | Ongoing credit facility (revolving) | Fixed-term payday loan |

| Loan amount | Up to £1,000 | £300–£1,000 |

| Term | Continuous: add and repay as you wish | 3–6 months |

| Funds access | Auto top-ups anytime | One-off transfer after approval |

| Bank monitoring | Required | Never |

| Early repayment | Flexible, saves interest | Allowed, saves interest |

| Direct lender | Yes | Yes |

| Credit check | Ongoing affordability monitoring | One-off affordability check |

| Hidden fees | No admin fees, but interest compounding | No hidden fees, fully transparent |

| Rollovers allowed | Effectively, yes | Never |

TIP: When comparing loans, focus on those that do not allow rollovers or continuous borrowing. Rollovers can increase your debt dramatically and lead to unmanageable repayment demands. Fixed-term loans with clear end dates give you peace of mind and help you plan your finances better.

How to Apply

- Go to our website with no forms to post and no queues.

- Complete the short form: income, essential expenses.

- Get a fast, clear decision within minutes.

- If approved, receive money within the hour.

No apps. No tracks on your bank. Just simple, responsible borrowing.

Responsible Borrowing Tips

- Borrow only what you need, knowing repayment won’t affect essentials.

- Fixed-term loans give clarity. You know when you’ll finish paying.

- Set reminders to stay on track.

- If things go wrong, reach out early. Don’t let missed payments build up.

- Explore budgeting toolst to avoid needing future credit.

TIP: I always tell borrowers to contact their lender immediately if they face difficulty repaying. Early communication often leads to manageable solutions. Ignoring the problem only makes things worse and could damage your credit score.

What You Could Try Instead

If SafetyNet’s revolving model feels risky, consider these:

- Payday Loans Online offers quick, fixed-term loans from £300 to £1,000, with instant decisions and same-day funding.

- Finio Loans, formerly Likely Loans, offers amounts up to £5,000 with longer repayment terms.

- OakbrookOne, launched in June 2025, is a new debt-consolidation loan from Oakbrook Finance and Experian. It’s a good option for clearing multiple debts.

All are FCA-authorised, offer clear APRs, affordable checks, and no hidden terms.

Where This Leaves You…

SafetyNet Credit’s closure in January 2023 and its revolving model show why so many borrowers felt trapped. You deserve better.

- A clear repayment plan

- Peace of mind about privacy

- A lender that’s fully transparent and regulated

Ready to Take Your Next Step?

You deserve borrowing that respects you and gives clarity. If you want a dependable, understandable loan:

- Need a set repayment plan and no surprises?

- Prefer no monitoring or roll-overs?

- Want a fully transparent, FCA‑protected loan?

If your answer is yes, you’re in the right place.

Click “Apply Now” or talk to us. We’re here to support you.

No shame. No stress. Just clarity, control, and respect. You’ve got this.

Cost and Repayment FAQ

How does your loan compare to SafetyNet Credit?

We offer fixed-term loans, so you see all costs up front. No ongoing interest stacking up.

How are repayments scheduled?

Monthly repayment on your chosen date. No surprise withdrawals.

When do repayments begin?

Typically one month after receiving the loan.

What if I can’t pay on time?

Contact us early, and we’ll support you. FCA rules protect you from escalation.

Who supports me if I struggle to repay?

Our team is friendly and non-judgmental. Plus, you can access free advisers at Citizens Advice.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.