Moving On From Provident: How to Find a Safe Loan Alternative

- Provident no longer lend. Payday Loans Online is a fast alternative, offering short-term loans from $300 up to $1,500 for urgent needs.

- You can no longer borrow from Provident as it shut down its home credit loans and ceased trading in December 2021.

- You should always check that any new lender is registered with the FCA to ensure the loan is safe and regulated.

- You can now apply for a payday loan fully online with instant decisions and funds typically sent within one hour of approval.

If you’re searching for a loan like Provident, you’re not alone. For decades, Provident was a household name, delivering doorstep loans repaid in person. After major industry reforms and compensation scandals, however, even the biggest lenders have vanished. You deserve safe, transparent and stress-free options for short-term borrowing. Let’s explore your next step.

Why You Need an Alternative to Provident

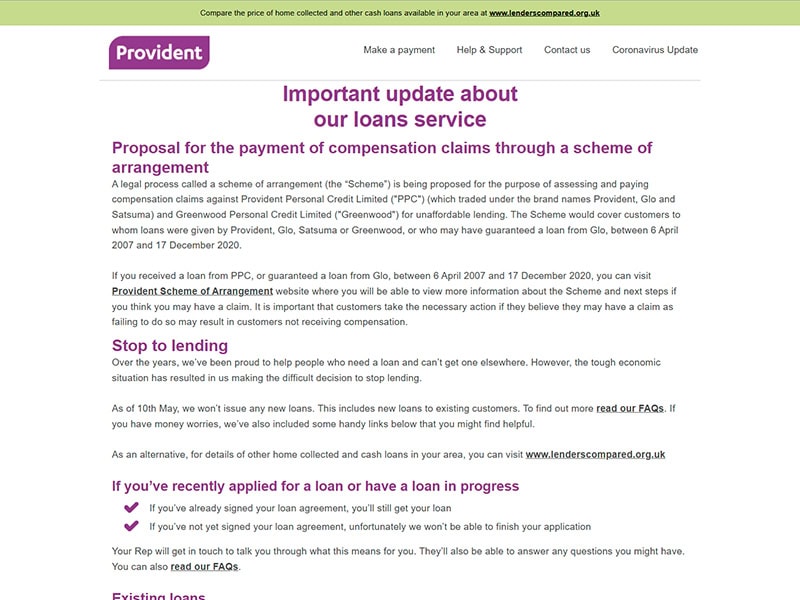

Provident Financial, founded in 1880, was synonymous with doorstep lending. Agents visited your home, dropped off cash, and collected repayments weekly. But that model came under fire. Plagued by mis-selling and affordability scandals and squeezed by new FCA rules, Provident announced the closure of its home credit operations on 10 May 2021. This marked the end of 141 years of service, according to reports from the Financial Times, The Guardian, and Reuters.

This move wasn’t just about closing doors. Provident wiped remaining balances and set aside a £50 million compensation scheme, although the FCA warned it didn’t fully cover customer losses, according to Reuters. Provident’s consumer credit arm officially ceased trading by 31 December 2021, as noted by sources including Wikipedia, Vanquis, and Reuters. Branches like Satsuma, Greenwood and Glo also shut down, reported by The Guardian, Wikipedia and Proactive Investors.

If you have an outstanding Provident loan, continue making repayments through their channels. For anyone seeking new short-term credit, Provident is no longer an option. And that’s okay.

TIP: I’ve seen many people feel lost after a trusted lender closes, but it’s important to remember there are still safe, FCA-regulated options available. Always check a lender’s registration on the FCA website before applying for a loan.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we’ve built our business around today’s lending standards:

- Fully online: No door visits, no hassle. Apply 24/7, from your own home.

- FCA-regulated: We follow strict UK lending rules. Your protection comes first.

- Fast results: Instant decisions, with funds usually in your account within one hour of approval.

- No hidden fees: All costs are displayed before you agree. Repay early and you save money. There are no penalties, ever.

- Inclusive: We assess your current affordability, not just past credit issues.

- Single, supportive platform: One login, clear dashboard, and customer help whenever you need it.

You’re in charge, from application to repayment.

Compare Provident vs Payday Loans Online

| Feature | Provident (Now Closed) | Payday Loans Online |

|---|---|---|

| Lending type | Doorstep or home credit loans have been widely covered in sources such as the Financial Times, Debt Camel, The Irish Times, The Times, Wikipedia, unifycu.org, Proactive Investors, and The Guardian. | Online payday loans (direct lender) |

| Loan amount | The amount is variable and often goes up to £1,000 or more. | £300–£1,000 |

| Loan term | Flexible, with repayments often made weekly. | 3–6 months |

| Application method | Agent visit, phone, or very limited online | Fully online, open 24/7 |

| Credit/affordability check | Limited and not always fully compliant. | Always performed (FCA required) |

| Funding speed | Slow, as it involves agent visits and in-person repayments. | Usually within 1 hour |

| Early repayment fee | Sometimes charged | No fees. Repay early and save. |

| Rollovers/ multiple loans | Sometimes allowed | Never allowed more than one loan at a time. |

| Funding status | Wind-down completed | Open, accepting applications |

| Transparency | Terms varied or buried in small print | All costs clear upfront |

| Customer support | Via agent or phone lines | Help is available online, by phone or email. |

How to Apply

- Visit our website. It’s secure and easy to use.

- Fill in your income and outgoings to help us lend responsibly.

- Get an instant decision, any time of day.

- Receive your funds usually within an hour if approved.

- Manage your loan online. Track it, make repayments, or reach out for help, all in one place.

No visits. No embarrassment. Just effective, respectful support.

TIP: I always recommend that you double-check your monthly budget before applying, so you’re confident you can manage repayments without missing other essential bills.

Responsible Borrowing Tips

- Borrow only for genuine emergencies, not ongoing bills.

- Check total repayment well before agreeing.

- Set reminders to avoid missed payments.

- Repay early to save money.

- Reach out early if things go off track.

If you need more help, Money Helper and Citizens Advice offer free and confidential support.

TIP: I’ve helped many borrowers who felt overwhelmed if you ever struggle with payments, contact your lender right away. Early communication can lead to support and affordable repayment plans.

Where This Leaves You and Your Choices

Provident and its doorstep model are part of history. You deserve credit that is transparent, fair, and easy to manage. At Payday Loans Online, that’s exactly what you get.

Ready to Take the Next Step?

- Do I want a quick, online application with cash in under an hour?

- Do I value clear terms and no hidden fees?

- Prefer a lender who’s regulated, supportive, and respectful?

If you answered yes, you’re in the right place. Apply now or contact us for advice, no pressure, just help. You’ve got this.

FAQ: Application & Approval

- Can anyone apply?

Yes, anyone aged 18 or over in the UK with a bank account and regular income can apply. If you have bad credit, we will still consider your application. - Is a credit check done?

Yes. We follow FCA rules to ensure you can afford repayments. It’s all about protecting you. - Do you charge fees?

No, there are no hidden, upfront, or early repayment fees. - When do I get the money?

Usually within 1 hour of approval. - What if I struggle to repay?

Contact us early. We’re here to help, and FCA rules support fair treatment. You can also access free help from Money Helper or Citizens Advice.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.