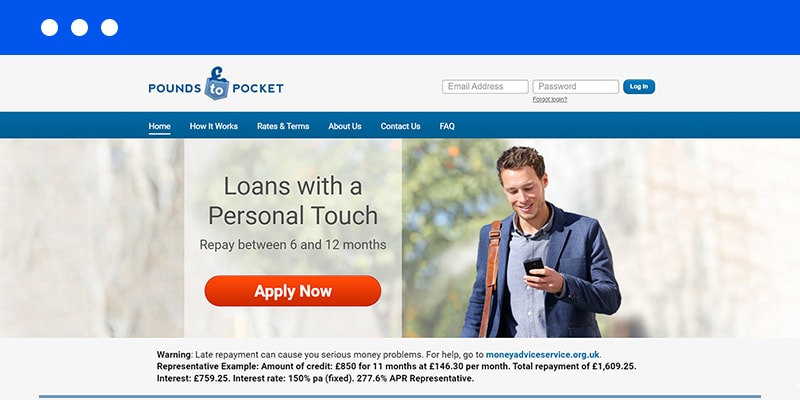

Pounds to Pocket loans alternative

Pounds to Pocket Is No Longer Lending

If you’re looking for some emergency cash from Pounds to Pocket, then you may now know they’ve entered administration. As a result, Pounds to Pocket payday loans has ceased lending, along with sister brand QuickQuid. All is not lost, however, as PaydayLoansOnline is here to meet your safe payday loans needs, and you can apply below.

PaydayLoansOnline can offer former customers of Pounds to Pocket seeking to top up loans attractive processing times. Our interest rates are fair and repayment terms flexible, providing a safe alternative to now closed lenders. If you’re looking for a secure loan, then you can apply online with PaydayLoansOnline today for £300 to £1000.

Former customers of Pounds to Pocket should contact them if they have outstanding balances. If you’re facing financial difficulties or simply need advice, please reach out. Help can be sought from independent charities such as StepChange and Citizens Advice. These charities can offer impartial advice surrounding your finances and any debts.

Our Pounds to Pocket payday loans alternative

If you’re seeking an alternative to your former Pounds to Pocket login, we may be able to help. You can borrow between £300 and £1000 from us, for between three and six months. We allow you to repay early at any time. PaydayLoansOnline also specialises in helping those with bad credit. Payday loans are an expensive form of borrowing, so consider alternatives first.

To ensure customers aren’t taking on unsustainable debt with us, we have the following policies:

- No rolling over loans

- Customers cannot have more than one loan with us at a time

- We will not lend multiple loans one after the other without a break

- Our main product can only be used a maximum of two times per year

These policies are in place to protect both you and us. If you’re facing financial difficulties, our product may not be suited to you. Contact independent help for further advice if you’re worried about your debts. If you need emergency funds and it’s the best option for you, apply below for a quick decision. If we’re unable to lend to you, we can sell your application to another lender with your permission. Other lenders have different lending criteria and may be able to help when we can’t.

Doing things differently to Pounds to Pocket

Pounds to Pocket reviews online provide a varied insight into the company and what customers felt about them. Ceasing new lending following Pounds to Pocket entering administration in 2019, you may be seeking an alternative. At PaydayLoansOnline, we like to do things differently. Being a new lender, we have had Financial Conduct Authority regulations integrated into our systems from the beginning. Our regulation by the FCA and full compliance with regulations is an added source of protection for customers.

We are an ethical lender and pride ourselves on not lending when it could cause financial difficulty. Payday loans such as Pounds to Pocket are not suitable for everyone and are expensive forms of borrowing. These high-cost forms of borrowing can lead to debt, and failure to repay can result in legal action. As a safe and regulatory-compliant lender, PaydayLoansOnline will always highlight the risks of our product. Cheaper forms of finance such as overdrafts and credit cards may be a more suitable alternative. Payday loans should only ever be used as a last resort when other options have been exhausted.

Pounds to Pocket Payday loans data

Payday loans similar to the offering from Pounds to Pocket are widely offered in the UK. Regulation around this sector of the lending market has increased, further protecting customers. Here is some interesting data on payday loans from the FCA.

- On average, consumers will repay 1.65 times what they originally borrowed.

- A price cap on fees was introduced, with the costs of borrowing going down for consumers since.

- The North West has the highest number of loans per adult (125 out of each 1000 people). Northern Ireland has the lowest number of loans per adult (only 74 for every 1000 people).

- 61% of payday loan borrowers have less confidence managing their money than the broader adult population of the UK.

Loans similar to those offered from Pounds to Pocket are expensive and risky. They can be helpful when alternatives are not available, however. If you can afford repayments on a payday loan and need cash, then we’re happy to receive your application.

Pounds to Pocket loan FAQs

Yes! Pounds to Pocket has entered administration and ceased lending. However, bad credit loans are still available. If you’re looking for emergency funding that’s paid within four hours of approval, apply with us below. We will take your current circumstances into account when assessing affordability. Bad credit doesn’t have to hold you back, and credit scores are only one part of our assessment process. Before you apply for a direct lender loan, consider potentially cheaper alternatives first.

Since entering administration in 2019, Pounds to Pocket and sister brand QuickQuid have ceased lending. Administrators are now working to wind down the Pounds to Pocket business. Former customers with outstanding balances will still make repayments in line with FCA regulations. If you need something similar to a Pounds to Pocket top-up loan, you can apply with us below.

With us, you can access completely safe short term loans online, and we’re fully registered with the FCA. We follow all FCA regulations and seek to be an ethical alternative to traditional lenders. You’re in good hands with us, but payday loans do come with risks. Payday loans like from Pounds to Pocket are expensive forms of borrowing with high interest rates. Cheaper alternatives such as arranged overdrafts and credit cards may be more suitable for your circumstances. Failure to repay your loan could result in legal action being taken against you and can worsen your finances.