Safe Alternatives to Peachy Loans: What to Know and Where to Turn

- Peachy Loans no longer lend. Payday Loans Online is a fast alternative, offering short-term loans from $300 up to $1,500 for urgent needs.

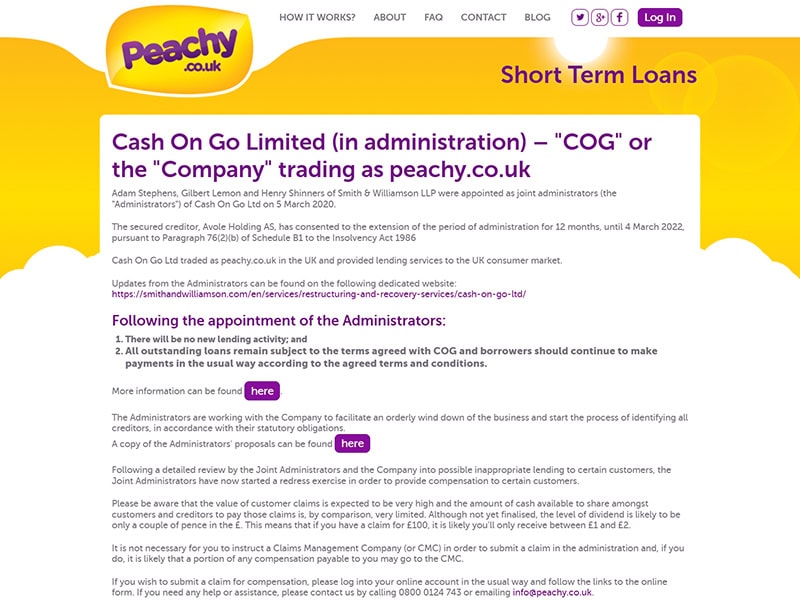

- Peachy Loans stopped lending in March 2020, so you must find a new FCA-regulated provider for short-term credit.

- You can only take one loan at a time with Payday Loans Online to help protect you from repeat borrowing and debt spirals.

- All Payday Loans Online costs are shown upfront, and you can repay early anytime without penalties to save on interest.

If you’re searching for “Peachy Loans” online, you’ve likely noticed that they stopped lending in the UK in March 2020. You’re not alone. Many people are looking for a fast, safe payday loan, but the market has changed. You deserve an option that’s simple, transparent, and puts your wellbeing first.

Why You Need an Alternative to Peachy Loans

Peachy Loans was a familiar brand, offering quick short-term loans online and via app. But after entering administration in March 2020, Peachy stopped issuing any new loans. If you’re still making repayments to Peachy, you should keep to your schedule. For new borrowing, you’ll need a different, trusted provider.

With many payday lenders disappearing, the landscape can feel uncertain. Your first priority should always be your safety and your future. That’s why, at Payday Loans Online, we believe in responsible, regulated lending that protects you.

TIP: I always recommend setting up a payment reminder on your phone or calendar if you’re repaying an old Peachy loan. This simple step can help you avoid late fees and protect your credit score.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we are:

- Fully FCA regulated: This means we follow strict rules set by the Financial Conduct Authority to protect your interests.

- Direct lender (and broker if needed): You deal directly with us for most loans. If we can’t help, we’ll only pass your details to another trusted lender with your permission.

- Transparent and ethical: All costs are shown upfront. We never hide fees, and we don’t encourage you to borrow more than you need.

- Strict about safety: Only one loan at a time, never back-to-back or rolled over. We limit usage to a maximum of twice a year.

- Support for all credit types: Bad credit is considered, but we will always check that you can afford repayments. No exceptions.

Compare Application, Speed, Cost, and Eligibility

| Feature | Peachy Loans (Closed) | Payday Loans Online |

|---|---|---|

| Lending status | Ceased March 2020 | Open to new applications |

| Loan amount | £100–£1,000+ | £300–£1,000 |

| Loan term | Short-term, up to 12 months | 3–6 months |

| Direct lender | Yes (when open) | Yes (broker if needed) |

| Early repayment | Allowed | Always allowed, no penalty |

| Multiple loans | Common (historically) | Never. It’s a strict policy. |

| Rollovers | Sometimes allowed | Never allowed |

| Application | Online/app | Online. It’s easy and quick. |

| Customer service | App, phone, email | Phone, email, live chat |

| FCA regulated | Was regulated | Regulated from the start |

Important Facts About Payday Loans Like Peachy

- Default fees: Under FCA rules, missed payment charges can’t exceed £15.

- Interest rates: Total fees and interest are capped at 0.8% per day.

- No never-ending debt: By law, you’ll never pay more in interest and fees than you borrowed, even if the loan is rolled over.

- Multiple loans are risky: FCA research shows most payday borrowers take out several loans a year. This can lead to serious financial problems.

At Payday Loans Online, we stick to these rules and go further by limiting how often you can borrow to protect you from a debt spiral.

TIP: From my experience, it’s safer to avoid taking out more than one short-term loan at a time. This helps you stay in control of your finances and avoid a cycle of debt.

How to Apply

- Visit our website. Applications are quick and easy.

- Fill out the form. We’ll check your income, expenses, and ability to repay.

- Get an instant decision. No endless waiting.

- Receive funds quickly. If approved, money is typically sent within an hour.

- Repay early anytime. You’ll save on interest with no penalties.

We’ll never encourage you to borrow more than you can afford, and we’ll always point out cheaper alternatives first.

Responsible Borrowing Tips

- Always check if cheaper credit options (like overdrafts) are available first.

- Only borrow in emergencies, never for day-to-day expenses.

- Use our affordability assessment. It’s quick and has no impact on your credit.

- Repay early if you can. Save money and stress.

- If debt feels overwhelming, speak to a charity like StepChange before borrowing more.

TIP: I’ve seen that using a free budgeting tool can help you decide if borrowing is really necessary. It can also show you areas where you might save money instead of taking out a loan.

Where This Leaves You and Your Choices

With Peachy Loans closed, the payday loan market can feel uncertain. But you still have safe, regulated options. Payday Loans Online offers a responsible alternative: direct, ethical, and always focused on your wellbeing.

Want quick cash, but don’t want to risk a debt spiral?

Need a lender who puts your safety first, and spells out every cost?

Looking for real support, with no hidden agenda?

If so, apply now or contact our team for honest advice. We’re here for you because your financial future matters.

Cost and Repayment FAQ

- How does your loan cost compare to Peachy?

All costs are shown upfront. Repay early, and you pay less. No extra charges, ever. - How are repayments scheduled?

Choose a date that suits you each month. No surprise withdrawals. - What if I can’t pay on time?

Contact us immediately. We’ll work with you, not against you. You can also seek help from StepChange or Citizens Advice. - Is there a penalty for early repayment?

Never. You’ll save money by paying off early. - Who supports me if I struggle?

Our team is here, and we’ll always encourage you to get free, independent advice if things get tough.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.