Safe Alternatives to MyJar Loans: A Guide for UK Borrowers

- MyJar Loans no longer lend. Payday Loans Online is a fast alternative, offering short-term loans from $300 up to $1,500 for urgent needs.

- Payday Loans Online is an FCA-regulated lender that offers transparent, ethical short-term loans with no rollovers or hidden fees.

- Repay early with Payday Loans Online to reduce costs, as there are no penalties or fees for early repayment.

- If you’re struggling with debt, contact free services like StepChange for support in managing payments and protecting your credit score.

If you’ve been searching for a MyJar loans alternative, you may already know that MyJar stopped lending in the UK. And it wasn’t quiet. You deserve reliable, transparent borrowing. Let’s explore what’s changed and how you can move forward safely with Payday Loans Online.

Why You Need an Alternative to MyJar Loans

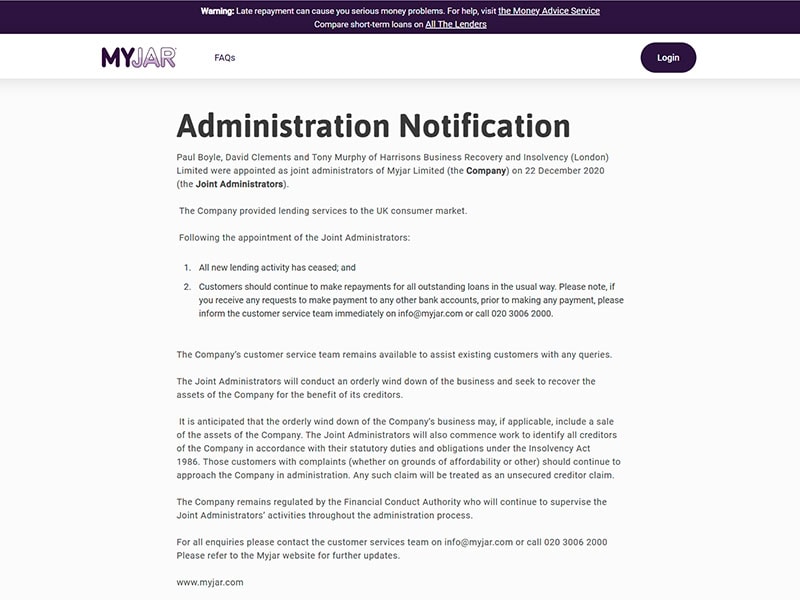

MyJar, once a familiar payday lender, entered administration on 22 December 2020 and immediately ceased all new lending. They left many borrowers unsure where to turn.

If you still owe money to MyJar, you should continue repayment as usual or get free advice from StepChange. For new loans, MyJar is simply no longer an option. This sudden shutdown left many in need of safe, regulated options they can trust.

TIP: If you’re struggling to repay old loans, I recommend you contact a free debt charity like StepChange. They can help you set up an affordable repayment plan and protect your credit rating.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we’ve built our business to be the lender you actually need today:

- FCA‑regulated: We’re authorised and regulated by the Financial Conduct Authority. Your protection is front and centre.

- Ethical lending: No roll-overs and no back-to-back borrowing. Just one loan at a time to help you get out of debt faster

- Inclusive credit policy: We’ll consider your real ability to pay, not just look at your credit score.

- Flexible repayment: Repay early anytime with no fees. Need to rearrange? We’ll work with you.

- Transparent costs: All charges and repayment dates are shown before you sign up.

- Direct lender: Deal with us directly. No brokers, no confusion.

Compare Key Features

| Feature | MyJar (Now Closed) | Payday Loans Online |

|---|---|---|

| Lending status | Closed December 2020 | Open and accepting applications |

| Loan amount | Up to £2,000 | £300–£1,000 |

| Loan term | Flexible short-term | 3–6 months |

| Direct lender | Yes (when open) | Yes |

| Application process | Online but now unavailable. | Online, fast, and ongoing |

| Approval time | Fast (when open) | Instant decision |

| Funding speed | Same day (when open) | Usually within 1 hour |

| Early repayment fee | None | None |

| Multiple loans | Sometimes allowed | Strictly one at a time |

| Roll‑overs allowed | Sometimes permitted | Never |

| Accept bad credit | Yes | Yes |

How to Apply

- Go to our website and use the simple form.

- Receive an instant decision with no waiting and no hassle.

- If approved, your money usually reaches your bank within an hour.

- Manage your loan online. Check your balance, make extra payments, and finish early with no penalty.

- Rest easy with no rollover traps and no hidden charges. Just clear terms and support.

Responsible Borrowing Tips

- Only borrow for genuine emergencies. Don’t use short-term credit for everyday needs.

- Use our affordability calculator to check repayments before applying.

- Repay early if you can. It reduces costs and is fee-free.

- Seek help before borrowing again if you’re struggling with existing debt.

- Set reminders so you don’t miss payments.

TIP: I’ve found that setting up payment reminders on your phone or calendar really helps you avoid late fees and protects your credit record.

Where This Leaves You and Your Choices

With MyJar gone, you may wonder who to trust. At Payday Loans Online, we offer ethical, FCA-regulated, and supportive lending designed for emergencies, not debt traps.

Ask yourself:

- Want your application handled directly and quickly?

- Need to know all costs up front, with no roll‑overs?

- Prefer a lending team that offers real help, not canned responses?

If you answered yes, you’re in the right place.

Ready to Take the Next Step?

Apply today or contact us for advice. No pressure, just support. You deserve peace of mind with your money. Payday Loans Online is here to help, clear, caring, and reliable.

You’ve got this.

FAQ: Cost & Repayment

How do your costs compare to MyJar?

Our loan is competitively priced, with all costs clearly shown before you commit. Pay early and you’ll save, as there are no early fees.

How are repayments scheduled?

Pick a monthly repayment date that suits you. We only debit the agreed amount, with no surprise withdrawals.

When do repayments start?

Typically one month after we send your funds.

What if I can’t pay on time?

Contact us early. We’re here to help, not worse your credit. The FCA requires this.

Who supports me if I struggle?

Our team is trained and supportive. You can also access help from StepChange or Citizens Advice.

TIP: If you ever worry about missing a payment, I encourage you to reach out to your lender as soon as possible. From my experience, the sooner you talk to us, the more options we can offer to help you stay on track.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.