Safe Alternatives to Cash Converters for Short‑Term Loans in the UK

- If Cash Converters won’t lend to you, Payday Loans Online is a fast alternative with easy-to-qualify short-term loans from $300 to $1,500.

- Cash Converters stopped offering UK personal loans in 2016 due to tighter lending regulations.

- FCA-authorised lenders offer safer short-term loans with clear costs and fair checks.

- You can apply online and receive funds within an hour from fully regulated UK loan providers.

If you’re looking for a fast, short-term loan and have noticed Cash Converters isn’t offering what you need in the UK anymore, you’re not alone. You need clarity, safety, and reliability. Here are safe, regulated ways to get the cash you need without the stress.

Why You Need an Alternative to Cash Converters

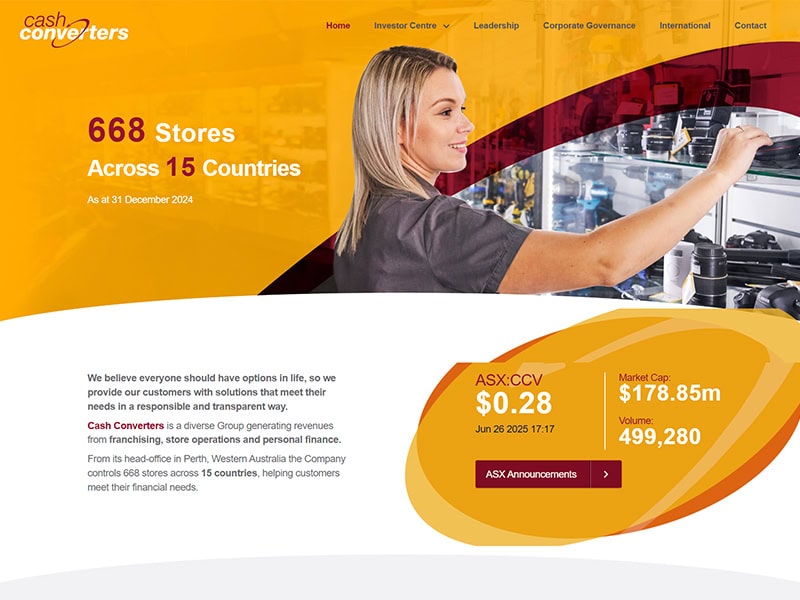

Many UK borrowers know Cash Converters, those high-street second-hand shops where you pawn your belongings or buy back what you sold. Until recently, they also provided various loans. But in the UK, their personal loan arm effectively stopped advancing new personal loans in May 2016 as part of a strategic wind-down amid tighter regulation, according to Annual Reports. That leaves a gap. You don’t have to fill it with risky lenders.

What’s worse, their past history raises concerns. In Australia, they settled fraud allegations and repaid customers millions for unaffordable loans, according to UK Government Assets, Lexology, and The Guardian. You deserve better.

TIP: I always advise that you avoid lenders with a history of unfair practices or unresolved complaints. Choosing a lender who is transparent and regulated protects you from risky loans that can worsen your financial situation.

When and Why They Closed.

Cash Converters’ Australian parent conducted a “strategic review” in 2016. The key finding was that UK personal loans were too risky under new laws. By May 2016, they stopped issuing new loans and began collecting on existing ones, according to gov.uk, Annual Reports, and reddit.com. Since then, there’s been no indication that UK consumers can get a new loan from them.

Plain and simple, if you’re based in the UK, Cash Converters is no longer an option for payday or personal loans. But there are better paths.

Who We Are and Why You Can Trust Us

At Payday Loans Online, we understand that emergencies happen. You deserve access to quick, straightforward loans without hidden traps. Here’s why you can trust us:

- FCA-approved: We’re authorised by the Financial Conduct Authority (FCA), the body that protects UK consumers.

- Transparent pricing: All costs and the APR (annual percentage rate, a standardised measure of loan cost) are shown upfront.

- No hidden fees: What you see is what you pay. We won’t hit you with surprise charges at the end.

- Fair affordability checks: We check your income and outgoings. We don’t discriminate just because of your credit score.

TIP: I recommend always checking that your lender is FCA-authorised before applying. This ensures you are protected by UK consumer law, which requires lenders to be fair, transparent and responsible with your money.

Compare Application, Speed, Cost, Eligibility

| Feature | Cash Converters (UK, pre‑2016) | Payday Loans Online |

|---|---|---|

| Application method | In-store only (pawnbroking, logbook) | Fully online. You can apply from anywhere. |

| Loan type | Secured loans require collateral. | Unsecured loans don’t require a guarantor or any collateral. |

| Speed | Slower process: visit in person, undergo assessment, then receive payout. | Very fast process: get a decision in minutes and money within an hour. |

| Regulation | Operated under FCA pre-2016 rules, with some loans offloaded to brokers. | Fully FCA-approved with up-to-date consumer protections. |

| Cost transparency | Fees could be hidden in small print | All costs clearly displayed and based on income |

| Eligibility | Based on asset value or expensive broker models | Open to more people, even those with less-than-perfect credit. |

How to Apply

- Visit our site and fill in the application.

- Enter your income and expenses for a full affordability check.

- Get an instant decision with no waiting and no guesswork.

- Receive funds in your bank within an hour if approved.

You control your borrowing. You see the costs. You decide what’s right for you.

Responsible Borrowing Tips

- Borrow only what you need, not just what you’re offered.

- Check affordability in advance.

- Set reminders to repay on time.

- Reach out early if you struggle; FCA rules protect you against escalating debt.

- Explore free advice if you’re feeling crunched. Debt charities can help at no cost.

TIP: I can’t stress enough how important it is to borrow only what you truly need and can afford to repay on time. Setting reminders and being proactive about repayment helps protect your credit score and avoid spiralling debt.

Where This Leaves You and Your Choices

You’re not trapped. Cash Converters may have closed their UK loan door in 2016, but you still have choices that are faster, safer, and fairer. At Payday Loans Online, we offer transparency, speed, and respect.

Ask yourself:

- Do I need help fast, without surprises?

- Do I want full transparency and no hidden fees?

- Do I want someone regulated by the FCA, with clear protection?

If your answer is yes, let’s do this right. Explore your loan options today no shame, just clarity and control.

Switching Options and Alternatives FAQ

What are my options now that Cash Converters is closed?

You can use FCA-approved online lenders like us with no stores and no hidden fees.

How can I compare safe alternatives?

Look for: FCA regulation, clear APR and fees, real affordability checks, and positive reviews.

What are the benefits of using Payday Loans Online?

Fast access, transparency, and fairness, even if your credit score isn’t perfect.

What steps now?

Visit our website. Use our affordability tool. Decide with confidence.

Where can I get advice on payday loan alternatives?

Try free UK resources like Citizens Advice or the Money Advice Service.

Kelly Richards is a UK finance writer with over 18 years of experience in personal credit. She founded the Cashfloat blog and now leads content at Payday Loans Online, where she focuses on helping readers make informed, confident borrowing decisions. Kelly holds a finance degree from the London School of Business and Finance.